Learn More About the Loan Estimate

What is the New Loan Estimate?

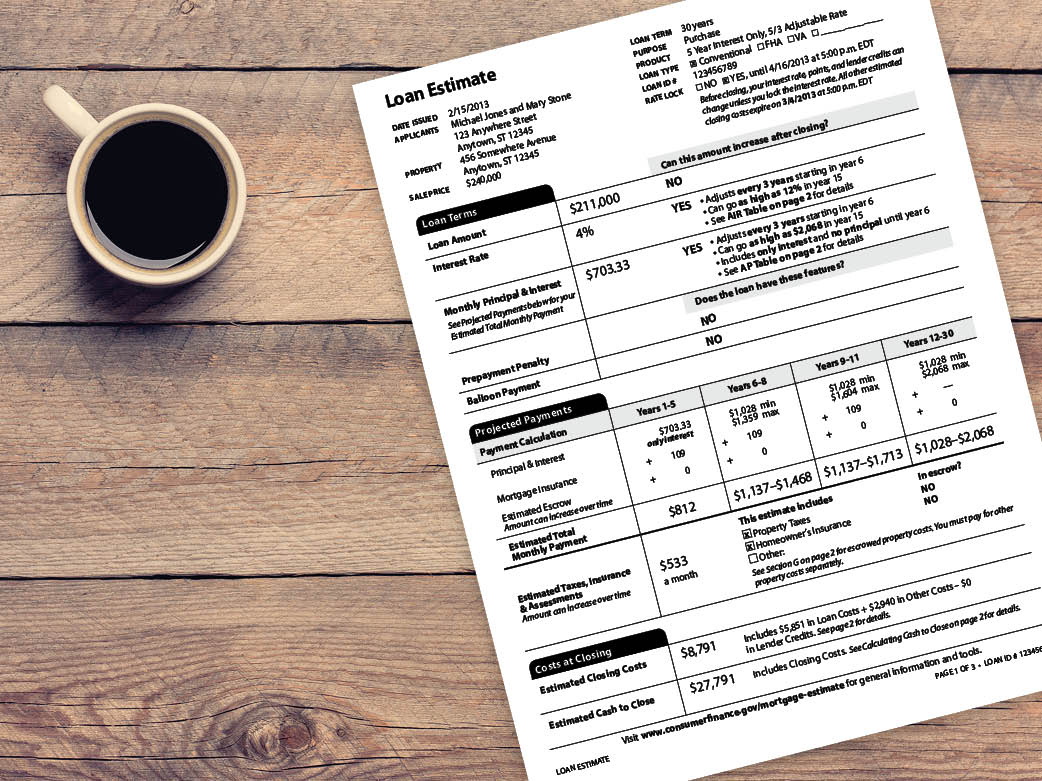

The Loan Estimate is one of the new TRID (TILA-RESPA Integrated) disclosures that will take effect this fall with the implementation of the CFPB’s Know Before You Owe rule. The goal of the Loan Estimate is to help borrowers better understand the costs associated with buying a home. The Loan Estimate is provided to borrowers within three business days of applying for a mortgage loan and must arrive at least one day before you receive your Closing Disclosure.

The Loan Estimate will combine two forms that are in use now – the early Truth-in-Lending form and the Good Faith Estimate. Confusion will be reduced by combining and simplifying the required disclosure information into one form.

What Information is on Loan Estimate?

The Loan Estimate will include the following basic types of information:

- Loan terms, including amount and interest rate

- Projected monthly payments

- Estimated Costs at closing, including pre-paid expenses

- Total interest you will pay if you keep the loan for the full term

Here is a sample Loan Estimate as provided by the Consumer Finance Protection Bureau: Sample Loan Estimate

Revised Loan Estimates

As stated, borrowers will receive the Loan Estimate within three business days of applying for a mortgage loan. During the course of the loan process, if certain costs on your Loan Estimate change significantly, you will receive a revised Loan Estimate. Items that could trigger a revised loan estimate include: costs changing more than allowable limits, your interest rate is locked in, and your loan loan amount or loan program changes. We encourage you to save the Loan Estimate and compare it against the Closing Disclosure document that you will receive three business days before your settlement (closing).

New Loan Estimate Effective Date

The CFPB recently proposed that the implementation of the new disclosures and regulations be delayed for two months. Instead of August 1, 2015, the CFPB has proposed that the effective date for TRID be moved to October 3, 2015 – see the CFPB news release here. While that date may seem far away, Realtors, lenders and Settlement Service providers must adjust their systems and processes to adhere with new rules.

Please check back here often for more information on TRID disclosures, rules, pending changes and implementation dates. As always, our goal is to provide our borrowers and business partners with exceptional lending services – preparing our partners and borrowers for TRID will help ensure a smooth transition for all involved.

Please do not hesitate to ask a question – email info@inlanta.com for more information or find a loan officer near you using our branch locator.

About Inlanta Mortgage

Headquartered in Brookfield, Wisconsin, Inlanta Mortgage is a growing mortgage banking firm committed to quality mortgage lending, ethical operations and strong customer service.

Inlanta Mortgage offers Fannie Mae/Freddie Mac agency products, as well as a full suite of jumbo and portfolio programs. The company is an agency approved lender for Freddie Mac and Fannie Mae, FHA/VA, FHA 203K and USDA. Inlanta Mortgage also offers numerous state bond agency programs. Review Inlanta’s mortgage loan programs.

Inlanta Mortgage was recently named a Top Workplace for a third time in 2015. Inlanta has also received the Platinum Million Dollar USDA Lender Award and has been recognized as a Top Mortgage Employer by National Mortgage Professional and a Top 100 Mortgage Banking Company and 100 Best Mortgage Companies to Work For by Mortgage Executive Magazine.

Inlanta Mortgage, Inc. NMLS #1016